Plunder: Financing the Panopticon

“If you want long-term success in business, relationships and life, you have to get better at accepting uncomfortable truths as fast as possible. When you refuse to accept an uncomfortable truth, you’re choosing to accept an uncomfortable future.”

~ Steven Bartlett, The Diary of a CEO

By Catherine Austin Fitts

Plunder is an ancient story. The promise of plunder brought Attila and the Huns over the Alps to raid the Roman Empire in northern Italy. It inspired the conquistadors of Spain to hunt for silver in Mexico and South America, where they wiped out the Aztec and Incan Empires. Protected by court intrigue and secrecy, pirates have teamed up for centuries with royalty whose reign depended on rich spoils to pay back their bank loans. When the leaders of the British Empire could not maintain a trade surplus, they flooded the Chinese with opium, conquering with addiction and gunboats what could not be secured with manufacturing and diplomacy.

The founding of the Bank of Amsterdam, the Bank of Sweden, and the Bank of England in the 1600s launched the beginning of the economic paradigm I call the “central banking-warfare model”—but we could just as easily call the dominant economic model the “central banking-plunder model.” Plunder in its many forms has been essential to the rich accumulation of capital that helped to build the Western world. You can grow wealth, or you can take it—and in many cases, taking it is the preferred method. Alibaba founder Jack Ma once said, “When trade stops, war starts.”

The long history of Western plunder inspired the formation of the intergovernmental organization known as BRICS (whose current membership includes founding members Brazil, Russia, India, and China in 2009, followed by South Africa in 2010, and Egypt, Ethiopia, Indonesia, Iran, and the United Arab Emirates in 2024-2025)1 and the BRICS nations’ ongoing efforts to achieve financial and military independence. More recent history helps explain Russia’s fierce resistance to NATO encroachment—the Russian people have not forgotten the “Rape of Russia”2 after the Soviet Union collapsed. As Samuel Huntington observed in his 1996 book The Clash of Civilizations:

“The West won the world not by the superiority of its ideas or values or religion (to which few members of other civilizations were converted) but rather by its superiority in applying organized violence. Westerners often forget this fact; non-Westerners never do.”

As technological innovation grows, so do the applications of plunder—along with its profitability. As David A. Hughes explained in our recent Omniwar report,3 “Omniwar” involves “the weaponization of everything.” Thus, instead of killing their prey physically in open combat, plunderers now can simply empty victims’ bank accounts while distracting them with propaganda and pornography. Plunder leaves students, who spend years getting an education that is not relevant to generating an income, with enormous student loan debt that they cannot retire. Frauds like the Madoff Ponzi scheme4 steal a mother’s savings, and when she commits suicide, her children’s inheritance can scarcely cover funeral expenses, much less finance their education and future. Plunder also encompasses the politically engineered health, food, and education policies that poison children. Moreover, the poisoning has a profitable postscript: the medical establishment claims that the children are sick (instead of poisoned),5 and parents liquidate their savings to try to heal their children in a manner that generates significant revenues for medical enterprises and pharmaceutical businesses.6

A key reason why the Solari team focuses on financial freedom7 is out of a desire to protect ourselves and our subscribers from being plundered. Because so much of the art of plunder involves management and manipulation of the financial system and the train tracks of transactions, we place great emphasis on having a good map of the world in which we live and understanding how to recognize the difference between “official reality” and reality. That is why the second of the six pillars of our Building Wealth curriculum8 is “Navigation Tools.”9 With the ability to develop and maintain a good map of reality, you can navigate. You can invest your time and resources to serve your purpose and achieve your goals, rather than find yourself plundered by someone trying to take the wealth—both the living and financial equity—that you have worked so hard to accumulate.

At Solari, our intention is not to depress you by dwelling on the unpleasant topic of plunder, but rather to help you build a strong immune system against being plundered. Ideally, you should also build networks and communities that help members do the same. Now is the time to do so, because technological innovation is powering the plunder game in new and challenging ways.

The 21st-Century Panopticon

We are in the midst of a quantum leap in the technology of surveillance and control. Let’s start with the metaphor of the “panopticon”—reintroduced in recent years by Ian Davis, Whitney Webb, and Mark Goodwin in their writings for Unlimited Hangout. English philosopher and social theorist Jeremy Bentham originated the term panopticon in the 18th century, Wikipedia explains, to convey the idea of “a design of institutional building with an inbuilt system of control…. The concept is to allow all prisoners of an institution to be observed by a single prison officer, without the inmates knowing whether or not they are being watched.”10 Davis, Webb, and Goodwin use “panopticon” to describe U.S. and Israeli surveillance, assassination, and warfare systems—including those supported by Palantir—as well as the public distributed ledger systems, including blockchain, being used to shift the financial system into a control grid.

In 1975, French philosopher Michel Foucault (1926–1984) described a panopticon as follows:

“The Panopticon is a machine for dissociating the see/being seen dyad: in the peripheric ring, one is totally seen, without ever seeing; in the central tower, one sees everything without ever being seen…. The ideal point of penality today would be an indefinite discipline: an interrogation without end, an investigation that would be extended without limit to a meticulous and ever more analytical observation, a judgement that would at the same time be the constitution of a file that was never closed, the calculated leniency of a penalty that would be interlaced with the ruthless curiosity of an examination, a procedure that would be at the same time the permanent measure of a gap in relation to an inaccessible norm and the asymptotic movement that strives to meet in infinity.”11

As governments and militaries around the world use satellite constellations, telecommunications, digital technology, and invisible weaponry to build a planetary panopticon, the U.S. administration and its allies are demonstrating the unique features of this new model. For example, on June 13, 2025, financed by the United States, Israel launched its war on Iran by assassinating 11 of Iran’s top military leaders and nuclear scientists. Some were reportedly targeted at home, resulting in the death of their families and neighbors. Describing the events, Ron Unz wrote, “I cannot recall any previous case in which a major country had ever had so large a fraction of its top military, political, and scientific leadership eliminated in that sort of illegal sneak attack.”12

In short, war has been converted to a high-powered manhunt with assassination as the end point. This is possible because, according to technology entrepreneur and economist Dr. Pippa Malmgren, U.S. and Israeli systems now can track all 92 million Iranians and identify each of them by their unique biometrics:

“The key to understanding all this is that Iran is now a digital Panopticon prison, now that the US and Israel, and probably some other regional allies of these two, can detect a person’s location, communications, conversations, and state of mind at any time, anywhere. The Iranian leadership is effectively already in a digital prison. A person can now be tracked based on their walking gait, unique heartbeat, voice, the network of people in their circle, and their own behavioral patterns. There is no place to hide in a digital Panopticon prison.”13

Moreover, as The Economist commented last year with respect to the legality of assassinations in Gaza, it is possible no military officer can be found guilty of an international war crime because it is software that is now choosing the targets. As we discussed in our interview and report on AI with Whitney Webb,14 AI has been positioned to assume responsibility and take the blame. This is why, in my introduction to the AI report, I warned, “the people who are using AI as a scapegoat are dangerous.”15

Anyone, Anywhere

It was immediately obvious that the Iranian assassinations had planetary implications. If software can identify each person in Iran, then, as long as Starlink or other U.S. satellite constellations are operating overhead, those who control the panopticon can identify pretty much anyone, anywhere. Whether with drones, invisible weaponry, or missiles, parties who are remote and unaccountable can influence targets’ thoughts and health or end their life—all on a highly economic basis.

In two important Solari Report interviews, “Control & Freedom Happen One Person at a Time”16 and “The Economy of the Energy Body,”17 Ulrike Granögger and I described how an automated and cost-effective control system has been built that is customized for each unique human. Thus, it did not surprise me when, following the deaths of the Iranian leaders and their families and neighbors, most European leaders fell right in line with increasing their country’s NATO contributions to 5% and agreeing to new tariff conditions. Add to this the financial controls of the sanction systems, or the Epstein-type files that surveillance and kickbacks create, and you start to see how the overriding of global treaties and laws and the extraction of tariffs from countries as well as corporations is working, as the control grid assembles and integrates into a global panopticon.

Although each one of us can be surveilled, tracked, and eliminated, the system doing the observation and pulling the trigger is invisible. No one is accountable. In fact, this opaqueness is an essential feature of control. In his 1984 classic, The Evolution of Cooperation, political scientist Robert Axelrod demonstrated in economic gaming scenarios the general population’s willingness to shun dirty players. This type of shunning is a powerful strategy that can advantage the players who cooperate and are willing to enforce against those who engage in dirty tactics. It only works, however, when the general population can see who’s who. In other words, transparency is essential to identify the dirty players.

Unfortunately, the panopticon has taken secrecy to a whole new level. It is no accident that alongside the descent of Western civilization into the panopticon, we have witnessed the growing success of media propaganda in making sure dirty players either remain invisible or (as an equally effective strategy) are portrayed as successful, rich, famous, and worthy of admiration.

Israel has played a significant leadership role in building the technology that powers the emerging planetary panopticon, and nothing demonstrates the plunder that these technological systems enable better than the genocide currently underway in Gaza. Antony Loewenstein’s The Palestine Laboratory: How Israel Exports the Technology of Occupation Around the World is an excellent source on the history of the prototyping of control technologies in Palestine.18

Israel’s crypto community has also played a leading role in developing and prototyping the distributed ledger technology essential to building financial transaction control systems. However, the systems—and the AI and databases that make the control grid go—are extremely energy-intensive. Building and operating the necessary data centers requires land, energy, and water. Now that the panopticon systems have matured, the Palestinian population is no longer useful, whereas their resources are seen as a valuable component of a profitable control grid infrastructure. Israel has, therefore, increasingly laid claim to Palestinians’ offshore oil and gas, land, and aquifers, while attempting to move the population out of Palestine, but—despite systematic destruction of Palestinians’ civilian, farming, and transportation infrastructure—the transfer of Palestinians to Egypt and neighboring countries has not succeeded. Consequently, the Israel Defense Forces (IDF) is now exterminating the population through bombings, sniper assassinations, and mass famine. Some reports indicate that the Palestinian population has dropped from 2.2 million—including 1.1 million children—to 1.6 million. Given the effort to force mass famine, a rapid die-off appears imminent.

Nothing has visually communicated plunder’s powerful potential better then a short AI-generated video retweeted by the U.S. President celebrating a redeveloped Gaza Riviera.19 Video scenes show a Trump golden statue and resort, and Elon Musk (let’s not forget his role as leader of the Starlink satellite network) enjoying a bowl of hummus while Trump and Netanyahu sip cocktails by a swimming pool. This video followed the publication of Netanyahu’s vision for Gaza, “Gaza 2035,”20 which in turn led to reports indicating that various neighboring Arab states have been cut in on the potential development deals. This public visioning process appears to have been used to syndicate potential plunder profits and build political constituencies for escalating the genocide. Gaza is a method,21 and we dare not forget it.

Understanding the Panopticon Threat

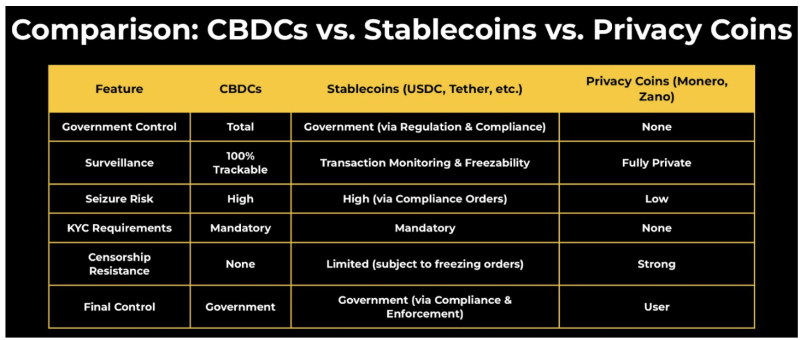

As control becomes more centralized and automated in the planetary panopticon, fewer human hierarchies are needed to maintain control. For example, why continue to spend billions on soft-power bureaucracies such as those fielded and funded by the U.S. Agency for International Development (USAID)? Who needs thousands of federal civil service workers to implement and enforce complex federal regulations? All of this can be done much more economically by controlling people’s money with programmable stablecoins, credit cards, and bank accounts. While many people cheered the firing of well-paid bureaucrats and nongovernmental organization (NGO) personnel, they seem not to appreciate the fact that the automated replacements will be far worse. I would much prefer to try to reason with a government bureaucrat than with an AI software bot that has no contact or support function and may have the power to cut off my bank account or electricity or send in a drone.

We face several challenges in understanding the panopticon. The first is understanding the point of view of the people who are building it. I just finished reading The Technological Republic: Hard Power, Soft Belief, and the Future of the West by Palantir CEO Alexander Karp and his general counsel, Nicholas W. Zamiska. Karp and Zamiska make the case that the West must maintain a superior capability in national security if it is to protect our way of life. This may sound like common sense, but the argument breaks down when you understand the relationship between Palantir’s U.S. government contracts and the U.S. build-out of a financial transaction control grid.

Look at Palantir’s role in building the Lavender system for the Israeli military—an AI targeting system used to direct Israel’s bombing in Gaza.22 Palantir is helping to build the planetary panopticon, paid for with our tax dollars but operating on behalf of a transnational crime syndicate. There is a difference between national security and digital concentration camps. There is a difference between national security and genocide with plunder. The line of who is protected and who is plundered is far more fluid than Karp and Zamiska describe. As Colombian President Gustavo Petro said in a July speech to the Hague Group:

“Gaza is simply an experiment of the mega-rich trying to show all the peoples of the world how they will respond to a rebellion of humanity. They plan to bomb us all.”23

The builders of the panopticon have sent a message: You are being watched and, at any time, you may be killed. This has nothing to do with national security—this is about the engineering of a coup d’état in the Western world. When the chief operating officer of Palantir claims that Palantir’s goal is to be the operating system of the U.S. government, he is stating that they intend the end of U.S. government sovereignty.

A second challenge is that plunder in the panopticon is facilitated with invisible weaponry that we do not understand. Do we think the tsunami in Indonesia in 2004 was natural? Nope. Do we think the fires in Northern California in 2017 or in Lahaina in 2023 were natural? Nope. Do we think Hurricane Helene and the floods in East Tennessee and Western North Carolina in 2024 were natural? Nope. That said, how do we know who is responsible? How do we see them? How do we figure out how they did it? How do we hold them accountable? That is the nature of the panopticon—we are seen, but they are unseen. And it is hard to pull the plug on or shut down the unseen.

A third challenge is the extent to which the financial panopticon diminishes market price discovery and financial disclosure. Private equity and credit are moving far more businesses out of the public market and into privately controlled hands. The federal government’s long-standing refusal to comply with federal audit and disclosure laws or to account for over $21 trillion of undocumentable adjustments—and the adoption of FASAB Statement 56 in combination with the existing national security and classification laws—have rendered large parts of the financial disclosure in the U.S. government as well as the U.S. stock and bond markets essentially meaningless.24

While these challenges are significant, they are also inspiring a backlash by those who understand that such assaults on fundamental productivity threaten to shrink the pie for one and all. If we can face the panopticon and understand that no one is as smart as all of us, we can work together to unleash the global hearts and minds of millions so that people come to see who is doing this and how their technology works.

In 2023, Peter Gabriel wrote a song along those lines called “Panopticom.” Wikipedia describes the song as follows:

“The song’s title references the panopticon, a prison structure designed by Jeremy Bentham that enabled prison guards to observe the actions of all of [sic] prisoners without being detected. Gabriel’s concept of the panopticom was to invert this model by enabling ‘ordinary people’ to observe the actions of authority figures. The ‘com’ in the panopticom refers to the ability for people to ‘communicate both to the globe and what’s going on in the globe. It’s turning surveillance on its head.’”25

“Panopticom” by Peter Gabriel26:

In the air

The smoke cloud takes its form

All the phones

Take pictures while it’s warmPanopticom, let’s find out what’s going on

Panopticom, let’s see where clues are leading

Panopticom, won’t you show us what’s going on?

Panopticom, show how much is realAnd we pour the medicine down

While we watch the world around us

We got witness on the ground

Takin’ in the evidence

And we reach across the globe

Got all the information flowing

You face the motherload

Tentacles around you, around youFrom above

And deep below the ground

It was in Berlin

That all the evidence was found

Look from the street

And we look down from the skies

See through the barriers

We can see through all those liesPanopticom, let’s find out what’s going on

Panopticom, let’s see where clues are leading

Panopticom, won’t you show us what’s going on?

Panopticom, show how much is real

Again, plunder is an ancient story. On the other hand, the effort to understand and map it and create systems to prevent it at scale by millions of people collaborating openly throughout the world is a very new story. This is the story in which the Solari team wishes to play a part. With this report dedicated to unpacking plunder, we invite you to build and protect your own wealth and to join us, in cooperation with others, in shifting the state of play entirely.

As Sherlock Holmes would say, “The game’s afoot!”

Pano

from: https://solari.com/plunder-introduction/