The Stablecoin Trap: The Backdoor to Total Financial Control

The walls are closing in on your financial freedom—but not in the way most Americans believe.

While the debate rages over the future threat of Central Bank Digital Currencies (CBDCs), a far more insidious reality has already taken hold: our existing financial system already functions as a digital control grid, monitoring transactions, restricting choices, and enforcing compliance through programmable money.

For over two years, my wife and I have traveled across 22 states warning about the rapid expansion of financial surveillance. What began as research into cryptocurrency crackdowns revealed something far more alarming: the United States already operates under what amounts to a CBDC.

- 92% of all US dollars exist only as entries in databases.

- Your transactions are monitored by government agencies—without warrants.

- Your access to money can be revoked at any time with a keystroke.

The Federal Reserve processes over $4 trillion daily through its Oracle database system, while commercial banks impose programmable restrictions on what you can buy and how you can spend your own money. The IRS, NSA, and Treasury Department collect and analyze financial data without meaningful oversight, weaponizing money as a tool of control. This isn’t speculation—it’s documented reality.

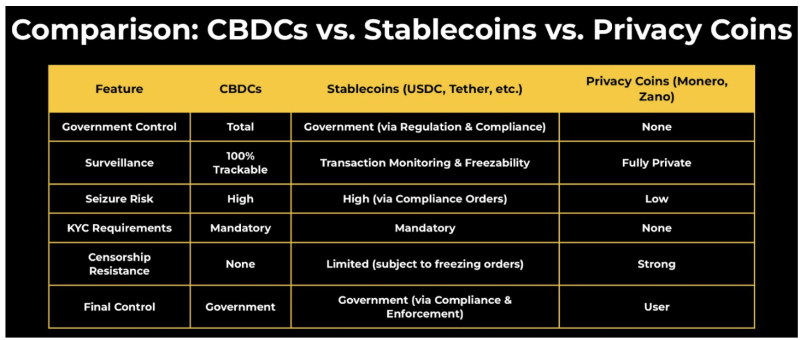

Now, as President Trump’s Executive Order 14178 ostensibly “bans” CBDCs, his administration is quietly advancing stablecoin legislation that would hand digital currency control to the same banking cartel that owns the Federal Reserve. The STABLE Act and GENIUS Act don’t protect financial privacy—they enshrine financial surveillance into law, requiring strict KYC tracking on every transaction.

This isn’t defeating digital tyranny—it’s rebranding it.

This article cuts through the distractions to expose a sobering truth: the battle isn’t about stopping a future CBDC—it’s about recognizing the financial surveillance system that already exists. Your financial sovereignty is already under attack, and the last off-ramps are disappearing.

The time for complacency has passed. The surveillance state isn’t coming—it’s here.

Understanding the Battlefield: Key Terms and Concepts

To fully grasp how deeply financial surveillance has already penetrated our lives, we must first understand the terminology being used—and often deliberately obscured—by government officials, central bankers, and financial institutions. The following key definitions will serve as a foundation for our discussion, cutting through the technical jargon to reveal the true nature of what’s at stake:

Before diving deeper into the financial surveillance system we face today, let’s establish clear definitions for the key concepts discussed throughout this article:

Central Bank Digital Currency (CBDC)

A digital form of central bank money, issued and controlled by a nation’s monetary authority. While often portrayed as a future innovation, I argue in “Fifty Shades of Central Bank Tyranny” that the US dollar already functions as a CBDC, with over 92% existing only as digital entries in Federal Reserve and commercial bank databases.

Stablecoin

A type of cryptocurrency designed to maintain a stable value by pegging to an external asset, typically the US dollar. Major examples include:

- Tether (USDT): The largest stablecoin ($140 billion market cap), managed by Tether Limited with reserves held by Cantor Fitzgerald

- USD Coin (USDC): Second-largest stablecoin ($25 billion market cap), issued by Circle Internet Financial with backing from Goldman Sachs and BlackRock

- Bank-Issued Stablecoins: Stablecoins issued directly by major financial institutions like JPMorgan Chase (JPM Coin) or Bank of America, which function as digital dollars but remain under full regulatory control, allowing programmable restrictions and surveillance comparable to a CBDC.

Tokenization

The process of converting rights to an asset into a digital token on a blockchain or database. This applies to both currencies and other assets like real estate, stocks, or commodities. Tokenization enables:

- Digital representation of ownership

- Programmability (restrictions on how/when/where assets can be used)

- Traceability of all transactions

Regulated Liability Network (RLN)

A proposed financial infrastructure that would connect central banks, commercial banks, and tokenized assets on a unified digital platform, enabling comprehensive tracking and potential control of all financial assets.

Privacy Coins

Cryptocurrencies specifically designed to preserve transaction privacy and resist surveillance:

- Monero (XMR): Uses ring signatures, stealth addresses, and confidential transactions to conceal sender, receiver, and amount

- Zano (ZANO): Offers enhanced privacy with Confidential Layer technology that can extend privacy features to other cryptocurrencies

Programmable Money

Currency that contains embedded rules controlling how, when, where, and by whom it can be used. Examples already exist in:

- Health Savings Accounts (HSAs) that restrict purchases to approved medical expenses

- The Doconomy Mastercard that tracks and limits spending based on carbon footprint

- Electronic Benefit Transfer (EBT) cards that restrict purchases to approved food items

Know Your Customer (KYC) / Anti-Money Laundering (AML)

Regulatory frameworks require financial institutions to verify customer identities and report suspicious transactions. While ostensibly aimed at preventing crime, these regulations have expanded to create comprehensive financial surveillance with minimal oversight.

Bank Secrecy Act (BSA) / Patriot Act

US laws mandate financial surveillance, eliminate transaction privacy, and grant government agencies broad powers to monitor financial activity without warrants. These laws form the legislative foundation of the current financial control system.

STABLE Act / GENIUS Act

Proposed legislation would restrict stablecoin issuance to banks and regulated entities, requiring comprehensive KYC/AML compliance and effectively bringing stablecoins under the same surveillance framework as traditional banking.

Understanding these terms is essential for recognizing how our existing financial system already functions as a mechanism of digital control, despite the absence of an officially designated “CBDC.”

The Digital Dollar Reality: America’s Unacknowledged CBDC

The greatest sleight of hand in modern finance isn’t cryptocurrency or complex derivatives—it’s convincing Americans they don’t already live under a Central Bank Digital Currency system. Let’s dismantle this illusion by examining how our current dollar already functions as a fully operational CBDC.

The Digital Foundation of Today’s Dollar

When most Americans picture money, they imagine physical cash changing hands. Yet this mental image is profoundly outdated—92% of all US currency exists solely as digital entries in databases, with no physical form whatsoever. The Federal Reserve, our central bank, doesn’t create most new money by printing bills; it generates it by adding numbers to an Oracle database.

This process begins when the government sells Treasury securities (IOUs) to the Federal Reserve. Where does the Fed get money to buy these securities? It simply adds digits to its database—creating money from nothing. The government then pays its bills through its account at the Fed, transferring these digital dollars to vendors, employees, and benefit recipients.

The Fed’s digital infrastructure processes over $4 trillion in transactions daily, all without a single physical dollar changing hands. This isn’t some small experimental system—it’s the backbone of our entire economy.

The Banking Extension

Commercial banks extend this digital system. When you deposit money, the bank records it in their Microsoft or Oracle database. Through fractional reserve banking, they then create additional digital money—up to 9 times your deposit—to loan to others. This multiplication happens entirely in databases, with no new physical currency involved.

Until recently, banks were required to keep 10% of deposits as reserves at the Federal Reserve. Covid-19 legislation removed even this minimal requirement, though most banks still maintain similar levels for operational reasons. The key point remains: the dollar predominantly exists as entries in a network of databases controlled by the Fed and commercial banks.

Already Programmable, Already Tracked

Those who fear a future CBDC’s ability to program and restrict money use miss a crucial reality: our current digital dollars already have these capabilities built in.

Consider these existing examples:

- Health Savings Accounts (HSAs): These accounts restrict spending to approved medical expenses through merchant category codes (MCCs) programmed into the payment system. Try to buy non-medical items with HSA funds, and the transaction is automatically declined.

- The Doconomy Mastercard: This credit card, co-sponsored by the United Nations through its Climate Action SDG, tracks users’ carbon footprints from purchases and can shut off access when a predetermined carbon limit is reached.

- Electronic Benefit Transfer (EBT) cards: Government assistance programs already use programmable restrictions to control what recipients can purchase, automatically declining transactions for unauthorized products.

These aren’t theoretical capabilities—they’re operational today, using the exact same digital dollar infrastructure we already have.

Surveillance and Censorship: Present, Not Future

The surveillance apparatus for our digital dollars is equally established. The Bank Secrecy Act mandates that financial institutions report “suspicious” transactions, while the Patriot Act expanded these monitoring requirements dramatically. The IRS uses artificial intelligence to scrutinize spending patterns across millions of accounts, while the NSA bulk collects financial data through programs revealed by Edward Snowden.

This surveillance enables active censorship, as demonstrated during Canada’s trucker protests in 2022, when banks froze accounts of donors without judicial review. Similar account freezes have targeted individuals ranging from Kanye West to Dr. Joseph Mercola—all using the existing digital dollar system.

In March 2025, the Treasury intensified this framework, lowering the cash transaction reporting threshold from $10,000 to $200 across 30 ZIP codes near the southwest border, subjecting over a million Americans to heightened scrutiny under the guise of curbing illicit activity.

The Semantic Shell Game

When politicians and central bankers claim we don’t have a CBDC, they’re playing a game of definitions. The substantive elements that define a CBDC—digital creation, central bank issuance, programmability, surveillance, and censorship capability—are all present in our current system.

The debate over implementing a “new” CBDC is largely a distraction. We’re not discussing whether to create a digital dollar—we’re discussing whether to acknowledge the one we already have and how to modify its architecture to further enhance surveillance and control.

Understanding this reality is the first step toward recognizing that the battle for financial privacy and autonomy isn’t about stopping some future implementation—it’s about confronting and reforming a system already firmly in place.

The Weaponization of Financial Surveillance

The government justifies financial surveillance under the guise of fighting terrorism, money laundering, and organized crime, but the data tells a different story. Since the passage of the Bank Secrecy Act (BSA) in 1970 and the Patriot Act in 2001, the US government has accumulated trillions of financial records on ordinary Americans, yet these laws have failed to curb financial crime. Instead, they have been used to target political dissidents, seize assets without due process, and criminalize cash transactions.

- The US Treasury admitted it cannot track $4.7 trillion in spending, yet demands compliance from individuals over transactions as small as $600.

- The Financial Crimes Enforcement Network (FinCEN) has harvested billions of transaction records but has failed to demonstrate any meaningful reduction in financial crime.

- Suspicious Activity Reports (SARs) are used to justify asset seizures without charges, while banks like JPMorgan and HSBC have laundered billions for drug cartels with no consequences.

- The US Dollar remains the primary currency for terrorism, human trafficking, and war financing—yet the government wants to blame privacy coins.

These financial laws were never about stopping crime—they were about controlling the people. Meanwhile, the same government that demands total visibility over our money has lost track of trillions and even funneled taxpayer dollars directly to terrorist groups. If financial transparency is so important, perhaps the US Treasury should be the first to comply.

Defining the Real Threat: The Government’s Surveillance Machine

Before we delve deeper, let’s cut through the noise and define the true stakes—because the focus on banning a Central Bank Digital Currency (CBDC) and vilifying the Federal Reserve misses the bigger picture. President Trump and others have zeroed in on the Federal Reserve as the architect of digital tyranny, with a public blame game unfolding as the Fed, federal government, and commercial banks point fingers at each other like squabbling overlords.

But this distraction obscures the real enemy: a government surveillance apparatus that already tracks, programs, and censors our money, paving the way for digital tyranny—social credit systems, digital IDs, vaccine passports, and more. The Federal Reserve is just one cog; the government’s machinery, backed by the banks that own the Fed, is the true enforcer.

The End Goal: Digitizing Everything

My two-year crusade against Central Bank Digital Currencies (CBDCs) stems from a chilling realization: the endgame isn’t just controlling our money—it’s digitizing all our assets—money, stocks, bonds, real estate, and more—under a global ledger with the same tracking and programmability as CBDCs.

As I detail in my book The Final Countdown, this vision involves CBDCs paired with Regulated Liability Networks (RLNs), systems designed to tokenize every financial instrument—stocks, bonds, and beyond—settling only in CBDCs. Countries like the US, those in Europe, the UK, and Japan are developing their own RLNs, engineered to interoperate, creating a seamless global ledger. The ultimate aim, rooted in the technocracy movement since the 1930s, is a single digital currency backed by energy credits, tying our wealth to resource consumption and a social credit system.

This isn’t speculation—it’s a deliberate blueprint. RLNs enable central banks and governments to monitor and program every asset, ensuring compliance with policies like carbon limits or social scores. The technocracy movement, founded by figures like Howard Scott in the 1930s, envisioned energy as the basis of economic value, a concept now resurfacing in digital form. This global ledger threatens to erase ownership and freedom, a reality already taking shape as governments and banks tighten their grip. This sets the stage to uncover how the US government’s surveillance machine, already in motion, accelerates this dystopian future.

The Government’s Surveillance Arsenal

The US government has perfected financial surveillance long before any CBDC label was applied, as I detailed in my Brownstone Institute article “Fifty Shades of Central Bank Tyranny.” The National Security Agency (NSA) bulk collects financial data on domestic and international transactions, a revelation from Edward Snowden exposing its access to phone calls, internet communications, and undersea cable intercepts—turning your bank account into a government peephole.

The IRS, wielding artificial intelligence, scrutinizes spending patterns with chilling precision, as seen in Rebecca Brown’s 2015 case, where $91,800 was seized via civil asset forfeiture for no crime, or the IRS’s recent mandate forcing Venmo and PayPal to report transactions over $600, ensnaring even the smallest earners. These AI tools transform every purchase into a potential target for government scrutiny.

The Patriot Act amplifies this overreach, authorizing warrantless wiretapping and data collection, while National Security Letters (NSLs)—like the one silencing Nick Merrill in 2004, gagging him from consulting a lawyer about FBI demands—ensure silence under threat of law. The Bank Secrecy Act compels banks to report “suspicious” activity, fueling Operation Chokepoint 2.0, where commercial banks like JPMorgan Chase and Bank of America froze accounts of dissenters—Kanye West, Melania and Barron Trump, Dr. Joseph Mercola—often exceeding federal directives. Congress, not the Fed, drives this surveillance juggernaut, embedding it through bipartisan laws like the Patriot Act, Bank Secrecy Act, CARES Act, and the addition of 87,000 armed IRS agents poised to audit the average citizen.

A Distinction Without a Difference

Focusing solely on the Federal Reserve as the villain is a distinction without a difference. The Fed, a private entity veiled in secrecy, is owned by the largest commercial banks—JPMorgan Chase, Citibank, and others—forming a cartel that profits from the system, as G. Edward Griffin’s The Creature from Jekyll Island exposes. Its digital money creation feeds these banks, which multiply it through fractional reserves. Eliminating the Fed and letting the government issue currency directly, as Senator Ron Wyden advocates—a stance I challenged at a conference where he opposed CBDCs but endorsed government control—wouldn’t end surveillance; it would intensify it. Wyden’s vision centralizes power further, removing the Fed’s buffer and amplifying government oversight with no accountability.

The real threat lies in the system’s design: digital money is already tracked and censored by government decree. Whether it’s the Fed’s Oracle databases or banks’ Microsoft systems, the infrastructure is programmable, enabling control without new laws—just new rules, crafted daily in backrooms. This surveillance machine, not the Fed alone, drives us toward a dystopian future where every transaction fuels tyranny. With this system already entrenched in the US, the global race for CBDCs—and the US’s pivot to stablecoins under the STABLE and GENIUS Acts—only accelerates the spread of this control, amplifying the threat both abroad and at home. We must confront this escalating reality head-on to grasp the full scope of the battle for our financial freedom.

Global CBDC Development Accelerates Despite Trump’s Ban

Even with President Trump’s Executive Order (EO) 14178, signed on January 23, 2025, banning the Federal Reserve and other US agencies from pursuing a Central Bank Digital Currency (CBDC), the global race to develop CBDCs has not slowed down—it’s actually speeding up. Before the EO, 134 countries and currency unions, representing 98% of global GDP, were actively exploring CBDCs, according to the Atlantic Council’s Central Bank Digital Currency Tracker. With the US stepping back from explicit CBDC work, that number drops to 133 countries.

The US accounts for approximately 26% of global GDP (based on 2024 World Bank estimates of a $105 trillion global GDP, with the US contributing $27 trillion). Subtracting the US share, the remaining 133 countries still represent about 72% of global GDP—a massive portion of the world economy—continuing their CBDC efforts. Meanwhile, the US has shifted its focus to a backdoor approach through stablecoins, empowering commercial banks and the Federal Reserve to extend digital control at the expense of privacy and decentralized finance (DeFi).

The US pivot isn’t just about stablecoins like Tether and USDC—it’s a broader strategy codified in two legislative proposals: the STABLE Act (House, February 6, 2025) and the GENIUS Act (Senate, February 4, 2025). These bills restrict stablecoin issuance to insured depository institutions, federal nonbanks, and state-regulated entities, effectively handing the reins to big banks like JPMorgan Chase and the Federal Reserve’s network of member banks.

The STABLE Act bans unauthorized issuers, while the GENIUS Act prohibits unapproved payment stablecoins, ensuring only the financial elite can play. Both mandate strict Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, turning every transaction into a surveillance opportunity. Algorithmic stablecoins used in DeFi platforms, which thrive on anonymity and decentralization, are effectively sidelined, as banks and the Fed tighten their grip on the digital dollar ecosystem. This isn’t innovation—it’s a power grab, cloaked as financial stability.

The pace of global CBDC development remains striking. In May 2020, only 35 countries were exploring CBDCs. By early 2025, that number had ballooned to 134 before the US exit, with 65 in advanced stages—development, pilot, or launch. Every G20 country except the US is now involved, with 19 in advanced stages and 13 running pilots, including Brazil, Japan, India, Australia, Russia, and Turkey. Three countries—the Bahamas, Jamaica, and Nigeria—have fully launched retail CBDCs, and 44 pilots are ongoing worldwide. This momentum persists despite Trump’s ban, as other nations see CBDCs as a way to modernize payments, enhance financial inclusion, and compete geopolitically, especially with China’s digital yuan (e-CNY) pilot, the largest globally, reaching 260 million people.

Recent developments underscore this acceleration. In Israel, the Bank of Israel released a 110-page design document in early March 2025, detailing plans for a Digital Shekel. This follows years of research and aligns with Israel’s participation in a 2022 project with the Bank for International Settlements to test international retail and remittance payments using CBDCs. The Digital Shekel aims to improve transaction efficiency and financial access across its tech-savvy population, marking a significant step toward implementation.

In the European Union, the European Central Bank (ECB) is pressing forward with its digital euro, targeting a rollout by October 2025. ECB President Christine Lagarde has been vocal about this timeline, stating in a recent address, “We are on track to introduce the digital euro by October this year, offering a secure and programmable complement to cash that ensures financial inclusion while maintaining privacy standards.” This follows the ECB’s October 2023 decision to enter the preparation phase for a digital retail euro, with a focus on both retail and wholesale applications. The EU’s push reflects a broader European trend, with countries like Sweden and the UK also advancing CBDC pilots, aiming to reduce reliance on US-dominated payment networks like Visa and Mastercard.

Across the Atlantic, Canada’s new Prime Minister, Mark Carney, who assumed office in March 2025, brings a pro-CBDC stance to the table. Carney, a former Governor of the Bank of England from 2013 to 2020, has long advocated for digital currencies as a tool for financial innovation. During his tenure at the Bank of England, he oversaw early CBDC research, including the July 2019 CBDC Technology Forum, which laid the groundwork for the digital pound.

Carney’s alignment with the World Economic Forum (WEF), where he has been a prominent figure pushing for sustainable finance and digital transformation, further underscores his support for CBDCs. The WEF has been a strong advocate for CBDCs, hosting roundtables through 2023 to promote interoperable designs. Under Carney’s leadership, Canada is likely to accelerate its CBDC efforts, building on the Bank of Canada’s 2023 analytical note emphasizing offline payment functionality—a move that could deepen digital control over Canadian finances.

Despite Trump’s EO, the global CBDC train is charging ahead, with the US taking a detour through stablecoins that empower banks and the Fed while stifling privacy and DeFi. The Digital Shekel, the EU’s October rollout, and Canada’s new leadership under Carney show that the world isn’t waiting for the US to catch up—it’s forging a digital future where control, not freedom, may be the ultimate prize.

Stablecoin Legislation: Backdoor CBDCs by Design

to read the rest of the artile, go to: https://brownstone.org/articles/the-stablecoin-trap-the-backdoor-to-total-financial-control/